The automotive sector has always received important tax incentives because vehicles are essential for urban mobility and because of the social interest in the automotive industry, which is one of the most important sectors of the Brazilian economy.

The main benefits include:

- Tax incentives for vehicle production in the North, Northeast and Center-West regions – Laws 9.440/1997 and 9.826/1999;

- Tax incentives for technological innovation in the automotive sector – Law no. 13.755/2018.

However, as you know, the initial idea of the Tax Reform is to completely abolish all existing tax benefits, but some advantages have been maintained for some sectors, such as the automotive industry.

The states have also granted various incentives related to ICMS for the segment, whether it be the granting of presumed credit or even a reduction in the tax rate when the specific requirements demanded by each federative entity are met.

Impact of the Tax Reform on the automotive industry

The rule mentioned above benefits automotive companies located in the North, Northeast and Midwest regions and aims to exclusively encourage the production of vehicles equipped with an electric motor that is capable of driving solely on electric power, with the possibility of combining it with an internal combustion engine that uses biofuels, either alone or simultaneously with petroleum-derived fuels.

This benefit has also been extended to companies, located in the same regions mentioned, that produce vehicles powered by an internal combustion engine that uses biofuels in isolation or cumulatively with petroleum-derived fuels.

These organizations will be entitled to a presumed credit from the Contribution on Goods and Services (CBS) until December 31, 2032, with the aim of exclusively encouraging the production of vehicles equipped with an electric motor, which has the capacity to drive the vehicle using only electricity.

In addition, another positive point for the sector is the implementation of full non-cumulativeness, allowing tax credits to be used in full, which will certainly bring benefits to the automotive industries. This is the foundation on which the Reform is based, aiming to eradicate the cascading effect that makes national taxation so expensive and complex. As a result, the industry will be able to enjoy a more predictable and equitable tax environment.

This will also put an end to the accumulation of ICMS credits, which is common in the sector, but which will not be part of the post-reform scenario. In addition, PLP 68/2024 establishes a 60-day deadline for the refund of credits, reducing the deadline to 30 days for companies that participate in tax compliance programs.

Points for attention

Moving on to the points that deserve more attention, there is real uncertainty about the Selective Tax – IS, popularly known as the Sin Tax, which will be levied on goods and services that are harmful to health and/or the environment.

While presumed CBS credits have been granted to the sector to encourage the production of vehicles with electric motors, cars, including electric cars, fall within the scope of the Selective Tax – SI.

At the moment, it is not possible to say what the impact of IS will be on the automotive industry, but certainly some companies could be negatively impacted by the incidence of this tax, which will increase the value of their products.

Another point to be monitored by the automotive industries is the fact that in 2032, when the benefits for the sector in the North, Northeast and Center-West regions will end, the cost of logistics could certainly make it impossible to maintain activities in these regions, which could lead to a geographical redistribution to places where most of their consumers are concentrated.

Complementary Bill 68/2024, which regulates tax reform, was approved by the Chamber of Deputies and now goes to the Federal Senate for consideration and presidential approval.

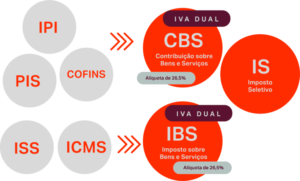

This bill is responsible for instituting the Tax on Goods and Services (IBS), the Social Contribution on Goods and Services (CBS) and the Selective Tax (IS). The approved text included an estimated 26.5% cap on the tax rate (CBS + IBS), along the lines of the Value Added Tax (VAT).

So we would have the following:

As for the IPI, whose initial idea was to be extinguished, it has been maintained so that from 2027 its rate will be zeroed, except for products that have incentivized industrialization in the Manaus Free Trade Zone.

Main changes compared to the current system

Below is a table summarizing the main changes brought about by the Tax Reform compared to the current system:

Even with so many uncertainties, it is possible to consider that the Tax Reform will be positive for the automotive sector.

Of course, implementing the changes and maintaining the effective tax burden will still require careful observation and assertive fiscal management.

Did you like the content? We hope it has clarified what will change in the automotive industry with the Tax Reform.

If you have any questions, click here and talk to our team of experts.