In February, Bill No. 7/2024 was presented to the São Paulo State Legislative Assembly (ALESP), proposing a change in the rates of the Causa Mortis and Donation Transfer Tax (ITCMD) in the state of São Paulo.

Currently, the state has a fixed rate of 4%. The bill aims to meet the requirement established in Constitutional Amendment 132/2023, based on the change in article 155, § 1 of the Federal Constitution, for the ITCMD to use progressive rates.

If the bill is approved, the fixed rate of 4% would be replaced by progressive rates varying between 2 and 8%, according to the following tax brackets:

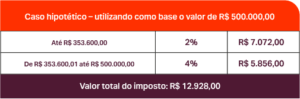

The tax will be calculated by breaking down the total value of the donation or inheritance between the bands. In other words, in a hypothetical case of a donation of an asset worth R$500,000.00, up to the amount of R$353,600.00 the 2% rate would apply, and the remaining amount would be taxed at 4%.

Check out a simulation that exemplifies the hypothetical case mentioned:

It is important to note that the bill is still awaiting analysis by ALESP, as well as analysis by the house’s merit committees. In addition, if the bill is approved this year and converted into law, its changes will have to comply with the principles of annual and nonagesimal anteriority, coming into force only in 2025.

In this way, asset transfers would be protected during 2024 at the current rate of 4%. This allows families to anticipate the search for effective and less costly succession and estate planning, benefiting from a significantly lower tax burden than that intended by the state of São Paulo.

–> Check out the details on the advantages of anticipating succession and estate planning by clicking here.

If you have any questions on the subject, our tax team will be happy to answer them.