What are logistics services?

Logistics services encompass various management activities, planning, checking and moving stocks, distribution centers, loading and unloading goods and creating strategic delivery routes.

All the activities linked to logistics services seek to optimize companies’ internal processes, since these structures play a decisive role for some sectors (agribusiness, the consumer goods industry, the retail trade, among others).

Logistics service providers can represent an internal sector of the business unit or they can operate through specialized companies that provide services.

Current tax regimes

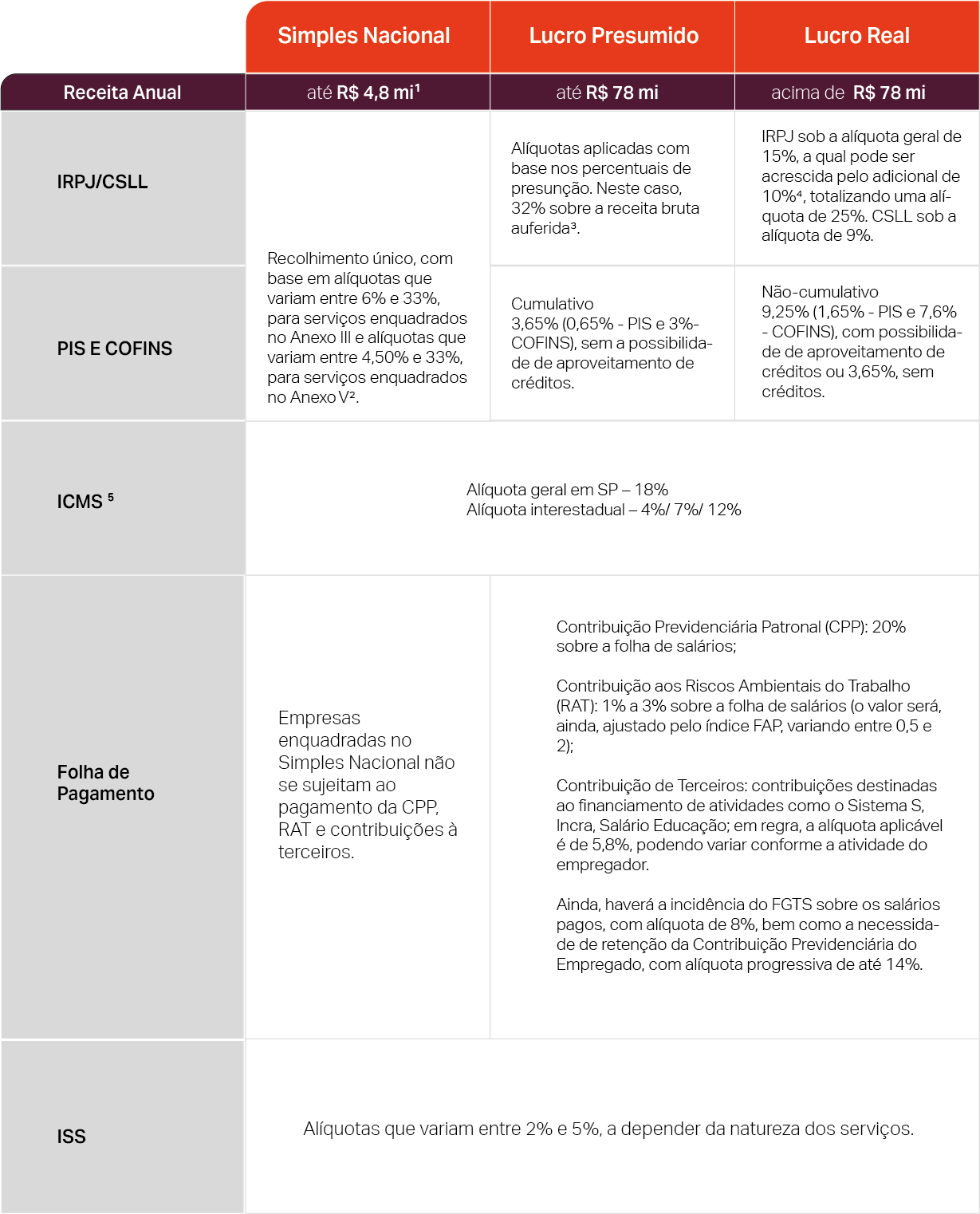

Currently, logistics service providers can opt for 3 tax regimes: Simples Nacional, Lucro Presumido or Lucro Real.

For each tax regime there is a specific tax burden. Below is a structured summary of the tax burden. Check it out!

[1] Sub-limit of R$ 3,600,000.00 created for the ISS hypothesis.

[2] It is worth mentioning that in order to calculate the tax due for the month, the taxpayer calculates the effective rate (gross revenue accrued in the last 12 months (x) rate set out in Annex II (-) portion to be deducted (/) gross revenue accrued in the last 12 months). Furthermore, if the ratio between payroll and gross revenue in Simples Nacional is less than 28%, Annex V will apply, which imposes higher taxation, with rates varying between 15.50% and 30.50%, according to the bands described (R Factor).

[3] It is important to note that some services can use the reduced rates, based on the exceptions provided for by law/instruction (such as Normative Instruction No. 1700 of 2017).

[4] Incident on the portion of profits that exceeds the annual amount of R$ 240,000.00 (equivalent to R$ 20,000.00 per month).

[5] Possibility of crediting.

Impact of the Tax Reform on the service sector

The unification of taxes and the simplification of the collection system are positive steps.

In addition, the tax reform seeks to create less distortion in the economic effects of the production chain by adopting the Value Added Tax (VAT) system, i.e. taxpayers will have the full right to use credits and taxation at destination.

The adoption of Value Added Tax (VAT) allows companies to benefit from the right to a tax credit for all the taxes (IBS and CBS) levied in the previous chain, with the right to offset these amounts against the taxes (IBS and CBS) levied on the provision of services.

Complementary Bill 68/2024

The first bill to regulate the Tax Reform has been approved by the Chamber of Deputies and is now heading for consideration by the Federal Senate and presidential sanction.

PLP 68/2024 is responsible for instituting the Tax on Goods and Services – IBS, the Social Contribution on Goods and Services – CBS and the Selective Tax – IS. The approved basic text included an estimated 26.5% cap on the rate of the future Value Added Tax (VAT).

The proposal states that an assessment will be made in 2031 to check whether the sum of the CBS and IBS rates, which will come into full effect in 2033, will result in a figure higher than 26.5%. In the event that the value is higher than estimated, a new bill will have to be sent by the Executive Branch, in conjunction with the Management Committee, in order to propose a reduction in benefits for sectors or products.

What will change with the approval of the Tax Reform?

Taxation will take place through the application of a maximum rate estimated at 26.5% on the company’s revenue. It is therefore undeniable that the services sector will suffer a real increase in the tax burden.

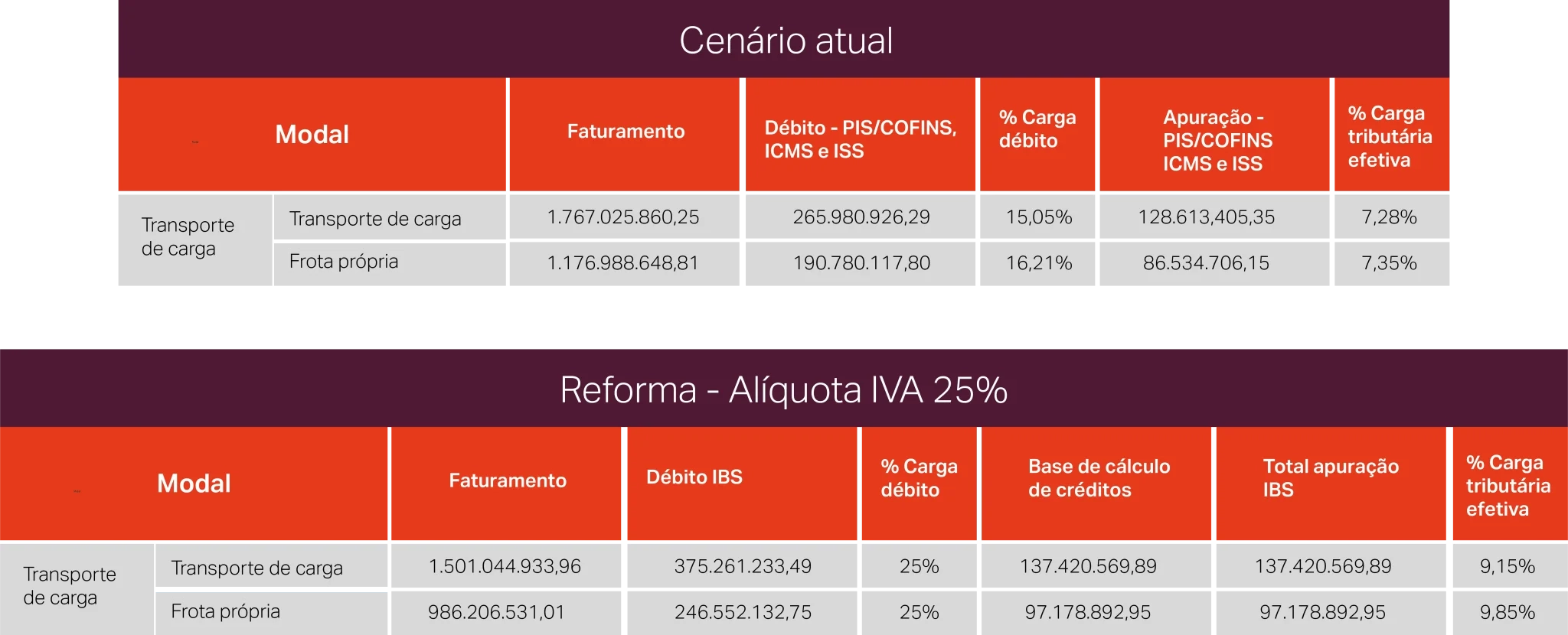

As an example, here is a comparison of the increase made by the National Transport Confederation (CNT) for the road freight transport sector, taking into account the VAT initially planned at 25%.

The analysis used two cargo transportation companies as a parameter in 2022, one with activities linked to subcontracting transportation services and the other with its own fleet. In both cases, only activities related to cargo transportation services in the domestic market were considered.

It’s worth mentioning that the figures above take into account operations with deferred or exempt ICMS, and the use of presumed ICMS, PIS and COFINS credits (operations involving subcontracting and the purchase of diesel fuel).

In this sense, looking at this hypothetical comparison, it is already possible to see the increase in the tax burden for the sector.

Despite the segment’s significant role in the development of many business operations, the final text approved did not include any possibility of reducing tax rates through “Differentiated Taxation Regimes”.

However, as a positive highlight for the sector, the basic text approved by the Chamber of Deputies included a fundamental point, the abolition of the homologation of credits generated from the purchase of fuels as inputs.

The table below summarizes the main changes brought about by the Tax Reform compared to the current system:

The comparative table above shows the changes that could occur with the Tax Reform in the services sector, specifically for logistics service providers.

Did you like the content? We hope it has clarified what will change for logistics service providers with the Tax Reform.

If you have any questions, click here and talk to our team of experts.