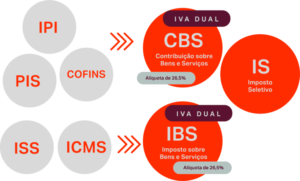

The approved Tax Reform will substantially modify the Brazilian tax model, creating tax guidelines and at the same time bringing our legislation into line with international formats. With the unification of taxes, the new model will have the following format:

In the course of approving the final text, various sectoral approaches were taken into consideration, including the textile industry, which is of great importance to the Brazilian economy.

According to data from the Brazilian Textile and Apparel Industry Association (ABIT), the sector has a turnover of approximately R$190 billion, ranks 4th in the world for apparel producers and is the second largest employer in the manufacturing industry.

The clothing segment, for example, is one of the most burdened by current taxation, given that a single garment can represent a tax of up to 40% of its final price, which shows that the sector is looking closely at all the effects projected with the Tax Reform.

In addition, it is important to note that the textile sector has a number of other obstacles in its production, such as: precarious transport infrastructure (roads, ports and railways), an extensive production chain and taxation in stages (as in the case of differentiated ICMS in each one), costs with skilled labor, among other factors that contribute to it suffering additional burdens.

Thus, with the approval of the final text, it is possible to see that the plan to simplify, reduce bureaucracy, reduce ancillary obligations and centralize payments is proving to be very beneficial for this sector.

Impact of the Tax Reform on the textile industry

Initially, the adoption of a single taxation model such as that established with the Tax Reform (VAT), through the application of a single rate of 26.5%, provides greater clarity in verifying the tax burden levied on each of the products sold. This in itself allows the industrial sector to effectively measure the price of the product to be sold and make it more attractive to the end consumer.

Transparency with regard to the incidence of taxes also contributes to the sector’s competitiveness, since by establishing more consistent prices, the marketed product gains ground on the international market.

Another point that benefits the sector is taxation at destination. The tax is only levied at the final consumer’s destination, in a single lump sum and at a single, predetermined rate, providing entrepreneurs with security, predictability and stability.

Furthermore, by eliminating the cascading effect of chain taxation, companies in the sector can make full use of the credits spent on their production, once again making the final product they offer more competitive.

So what we can see is that, although the sector has not been covered by any of the differentiated or specific rate reduction regimes, it is possible to see that, in the long term, it will be able to see some benefits from adopting the new model.

Complementary Bill No. 68/2024

The first bill to regulate the Tax Reform was approved by the Chamber of Deputies and is now heading for consideration by the Federal Senate and presidential sanction.

PLP 68/2024 is responsible for instituting the Tax on Goods and Services, the Social Contribution on Goods and Services and the Selective Tax. The basic text approved included an estimated 26.5% tax rate (CBS + IBS), following the model of the Value Added Tax (VAT).

The proposal calls for an assessment to be carried out in 2031 to check whether the sum of the CBS and IBS rates, which will come into force in full in 2033, will result in a figure higher than 26.5%. In the event that the figure is higher than estimated, a new bill will have to be sent by the Executive Branch, in conjunction with the Management Committee, in order to propose a reduction in benefits for sectors or products.

Main changes compared to the current system

Below is a table summarizing the main changes brought about by the Tax Reform compared to the current system:

The comparative table above shows the changes that could occur with the Tax Reform in the textile industry.

Did you like the content? We hope it has clarified what will change in the textile industry with the Tax Reform.

If you have any questions, click here and talk to our team of experts.